To lodge a claim, complete an Injury Claim Form or Fatality Claim Form.

You can complete the form online or print and complete a paper form. Find out more about lodging a claim.

Send the form to the CTP Insurer of the vehicle that caused the accident (the 'at-fault vehicle').

If you complete the form online, you can find the at-fault vehicle’s CTP Insurer using the inbuilt search function at the start of the form.

If you complete a printed form, you can use CTP Insurer Search to find the at-fault vehicle's CTP Insurer.

Once the insurer receives your form, they will contact you within seven business days. A claims consultant will introduce themselves, give you a claim number, and help you through the next steps.

Make a note of your claim number. You will need to give this to your health provider/s, so they can send invoices directly to the insurer

Unknown or unregistered vehicles

You can still lodge a claim if you do not know the at-fault vehicle's details, or if they were unregistered.

Send your completed claim form to the CTP Regulator. We will allocate your claim to one of the CTP Insurers and contact you to tell you that we have done this.

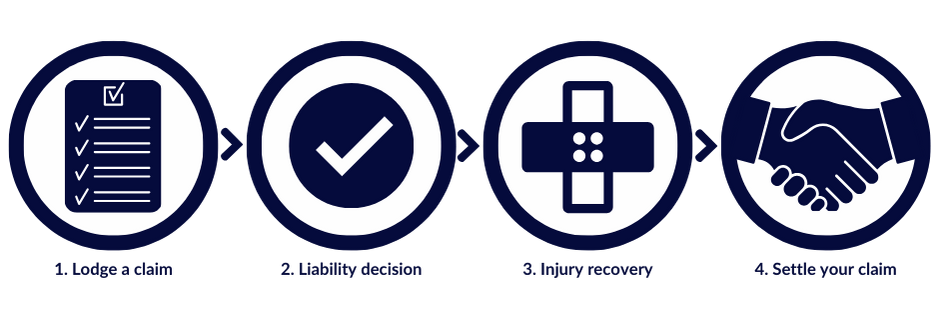

Once the CTP Insurer has your claim, they will make a decision about who caused the accident, and to what extent. This is called 'determining liability'.

To do this, the insurer might, for example:

- Talk to you about what happened in the accident

- Contact the other driver and any witnesses

- Get a copy of the South Australia Police report

- Look at any photos or videos of the accident or vehicle damage.

This process can take some time. Sometimes, the insurer will agree to pay for your treatment, care and support, even though they have not decided who caused the accident. This is called making payments on a 'without prejudice' basis.

When a decision has been made, the insurer will write to you. Their letter will say:

- Whether they accept or deny liability (partly or fully)

- How they've made their decision, and what evidence they looked at

- Whether any statutory reductions apply (for example, if you were not wearing a seatbelt).

If you disagree with the insurer's decision, contact the insurer as soon as possible to discuss your concerns. If you still disagree, find out more about your complaint and dispute resolution options.

For more information, read our Liability determination fact sheet.

If your claim is accepted, the insurer will pay for medical treatment, care and support that is:

- reasonable and necessary, and

- treating injuries caused by the motor vehicle accident.

The insurer may need to get information about your medical background. This is to confirm that your injuries were caused by the motor vehicle accident, and to understand any pre-existing injuries or conditions you had.

You should talk to your claims consultant about your recovery, and what treatment you think you will need.

Find out more about what's covered.

You can support your injury recovery by:

- participating in the recommended treatment and rehabilitation, and

- trying to return to work and your normal activities as soon as you can.

Once your injuries are stable, the insurer will work with you to finalise and settle your claim.

Sometimes, they will ask you to undergo an Injury Scale Value medical assessment. This helps the insurer understand your injuries and what sorts of compensation (if any) you can receive.

The insurer will make you an offer in writing. They will explain what they are offering, and for what reasons. You can accept the offer, or reply with a counteroffer that you think is more appropriate.

Find out more about settling your claim.