The CTP Scheme Services fee, shown on the registration renewal form, consists of an Administration Fee and Stamp Duty paid on the other components of the CTP Insurer Premium.

The Stamp Duty included in the CTP Scheme Services fee is charged on the CTP Premium as required under the Stamp Duties Act 1923. The amount is calculated as 11% on the CTP Insurer Premium, GST on the CTP Insurer Premium, and the CTP Scheme Services fee.

GST is charged at a rate of 10% on the CTP Insurer Premium component only.

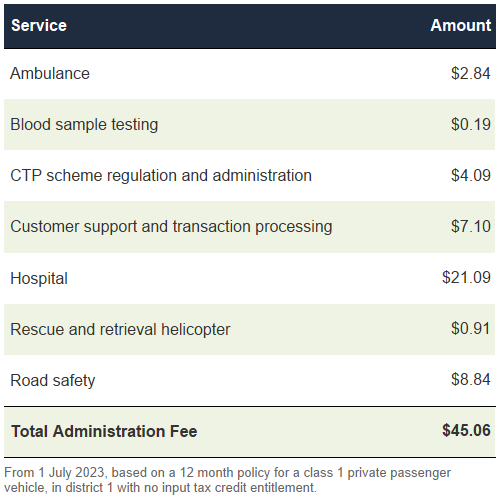

The Administration Fee is determined by the CTP Regulator when premium limits are set for each financial year, and it differs across premium classes.

The Administration Fee is paid to various government entities for the following services provided:

- Ambulance services – provided by SA Ambulance as a result of motor vehicle trauma.

- Blood sample testing – provided by Forensic Science SA on behalf of the

Attorney-General’s Department for blood and alcohol testing as a result of motor vehicle trauma. - CTP scheme regulation and administration services – provided by the CTP Regulator for the CTP Scheme, and for the Motor Accident Injury Accreditation Scheme (which provides independent medical expert assessments).

- Customer support and transaction services – provided by the Department for Infrastructure and Transport associated with the collection, recording and processing of CTP insurance premiums.

- Hospital services – provided by the Department for Health and Wellbeing for motor vehicle trauma.

- Rescue and retrieval helicopter services – provided by the State Rescue Helicopter Service on behalf of the Attorney-General’s Department as a result of motor vehicle trauma.

- Road safety services – provided by South Australia Police to promote programs designed to reduce the incidence or impact of road accidents and injuries.