This annual report is presented to Parliament to meet the statutory reporting requirements of the Compulsory Third Party Insurance Regulation Act 2016.

This report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Kim Birch

Chief Executive & CTP Regulator

From the Chief Executive

On 30 June 2020 the South Australian CTP Scheme (scheme) completed its first year of competition.

The opportunity for motorists to choose their CTP Insurer has seen competition based on price, service and approved incentives for the benefit of policy holders and claimants. Almost all motorists found the renewal process easy (95%) and the majority of motorists like the change (59%).

The claimant service rating increased from an average of 70 out of 100 at the start of competition to an average of 79 out of 100 by June 2020, demonstrating an overall improvement in the service reported by claimants since the introduction of the rating.

This year saw the first review of the CTP insurance rating district boundary, resulting in an amendment to the district boundary to ensure fairness in the collection of CTP premiums.

We have all had to adapt to the challenges brought about by the COVID-19 pandemic. I would like to acknowledge my team’s success in transitioning to working from home, and continuing to deliver our scheme functions. CTP Insurers have adapted to maintaining services to claimants and policy holders. We are monitoring the impacts of the pandemic on the scheme. This includes monitoring timely access to early intervention and treatment, reimbursement to claimants for out of pocket expenses and expedient claim settlement. There is no evidence to suggest that claimants have been disadvantaged because of the pandemic.

The annual premium setting process for 2020-21 was successfully undertaken remotely as a result of travel restrictions. There is a structured process to monitor adequacy of the premium bands during the year and ability to re-determine the bands if there is significant changes to the risk premium drivers.

The Regulator also commenced an annual insurer based compliance program. While completion was delayed by the impact of COVID-19 restrictions and the ability to conduct onsite reviews, it has been an important addition to the compliance framework, providing me with meaningful insights into CTP insurer performance. The compliance program will be completed in the first quarter of 2020-21.

In my role as Motor Accident Injury Accreditation Scheme (MAIAS) Administrator I oversaw the first re-accreditation of medical experts. The MAIAS also monitored the impacts of COVID-19 resulting in the development of a process to trial telehealth for pure mental harm GEPIC assessments in the 2020-21 financial year.

Areas for focus in the next 12 months include understanding injured road users and any barriers to their interaction with the scheme along with the claimant experience. Initiatives will focus on removing barriers to efficient claim lodgement, speedy resolution of claims and measuring scheme utilisation.

Kim Birch

Chief Executive and CTP Regulator

Overview: about the CTP Regulator

The CTP Regulator was established on 1 July 2016 to oversee the scheme and regulate CTP Insurers. Since this time, the four Government approved insurers AAMI, Allianz, QBE and SGIC (CTP Insurers) have underwritten the South Australian scheme and managed the claims against the CTP Policy of Insurance (policy).

On 1 July 2019 the scheme transitioned to a competitive model where motorists actively choose their CTP Insurer based on a number of factors including brand, service, price, and approved incentives.

Fundamental aspects of the scheme are:

- the motor vehicle registration renewal and CTP premium are paid in one transaction

- premiums may only be differentiated based on one or more of the following: vehicle type, vehicle use, garaging location and entitlement under GST law to an input tax credit for CTP insurance premiums

- the policy is identical across the four CTP Insurers.

CTP insurance premiums provide cover under a compulsory policy. The policy is attached to the vehicle, not an individual. The minimum terms and conditions of the policy are set by the Regulator and are available on the Regulator’s website www.ctp.sa.gov.au.

The policy protects the owner of a vehicle and other people who use the vehicle, with or without the owner’s consent, against the financial impact of causing injury or death to other road users through the use of the vehicle anywhere in Australia.

CTP insurance is governed by South Australian legislation in the following Acts of State Parliament: the Motor Vehicles Act 1959 (MV Act), the Civil Liability Act 1936 and the Compulsory Third Party Insurance Regulation Act 2016 in addition to contracts between the State and CTP Insurers.

In South Australia, claims for compensation under the scheme are fault-based common law claims modified by statute, principally the Civil Liability Act 1936. This means injured road users may be eligible for injury recovery support, payment of reasonable and necessary treatment, and compensation when another party is at fault or partially at fault. Access to compensation requires the injured person to meet thresholds depending on the seriousness of the injury.

The Regulator is appointed as the Nominal Defendant under Part 4 of the MV Act. Nominal Defendant claims arise when the vehicle responsible for a motor vehicle accident in South Australia that results in injuries to other road users, is either uninsured or unidentified. The Regulator assigns management of Nominal Defendant claims to the CTP Insurers in line with their market shares.

The scheme also provides reasonable and necessary treatment, care and support for children under the age of 16 years injured in an accident on South Australian roads, regardless of whether the child or a South Australian registered motor vehicle was at fault.

The purpose of the Regulator is to deliver a high-performing competitive CTP Scheme that offers choice, ease and confidence to the South Australian community. The Regulator is established as an independent statutory authority under the Compulsory Third Party Insurance Regulation Act 2016 (the Act). The Regulator’s functions are funded from the administration fee component of the CTP premium paid by motorists upon registration of their motor vehicles.

Regulator functions

Under section 5(1) of the Act, the Regulator must:

- regulate CTP Insurers, and perform any other function relating to CTP Insurers conferred on the Regulator under the MV Act

- determine premium amounts payable for CTP insurance policies

- determine the minimum terms and conditions of CTP insurance policies

- monitor, audit and review the operations and efficiency of the CTP Scheme

- provide information to consumers about the scheme and CTP Insurers

- make, monitor the operation of, and review rules and guidelines for CTP Insurers relating to:

- premium determination

- claims management

- dispute resolution

- providing information to consumers

- any other relevant matter

- make recommendations to the Minister in relation to:

- eligibility criteria for insurers seeking approval under part 4 of the MV Act

- terms and conditions of any agreement or contract entered into between the Minister and the CTP Insurer

- assessment of an application from an insurer for approval or withdrawal of an approval under Part 4 of the MV Act

- administer the Act and exercise any other function conferred on the Regulator under any other Act.

The Regulator was appointed as the Motor Accident Injury Accreditation Scheme (MAIAS) Administrator by the Attorney-General under section 76 of the Civil Liability Act 1936. The MAIAS Administrator has administrative and financial responsibility of the MAIAS which was established to accredit health professionals to undertake Injury Scale Value (ISV) medical assessments.

An ISV medical assessment is used to assist in determining an injured road user’s entitlement to compensation by following a comprehensive claimant assessment assigning referred injuries to ISV Item numbers listed in Schedule 1 of the Civil Liability Regulations 2013. The ISV is a value between 0 and 100 that reflects the level of adverse impact of the injury on the person, based on medical evidence.

The MAIAS Administrator uses the MAIAS Rules to oversee the performance of the medical practitioners. The rules prescribe the regulatory and service standards required for medical practitioners to achieve and maintain accreditation.

As administrator of MAIAS, the Regulator’s responsibilities include but are not limited to:

- prescribing the processes and documentation of the MAIAS

- prescribing accreditation training courses and overseeing their implementation

- making recommendations to the Minister for approval of applicants who meet the accreditation criteria

- monitoring the performance of Accredited Medical Practitioners (AMPs) to ensure conformity with accreditation obligations

- conducting investigations into alleged breaches of these conditions

- maintaining and keeping an up to date register of all Accredited Medical Practitioners

- continuing oversight of the MAIAS.

Deliver a high performing competitive CTP Scheme that offers choice, ease and confidence to the South Australian community.

Our values | What this means for us |

|---|---|

Outcomes driven

|

|

Accountable

|

|

Collaborative |

|

Fair

|

|

Supportive |

|

During 2019-20 there were no changes to the agency’s structure and objectives as a result of internal reviews or machinery of government changes.

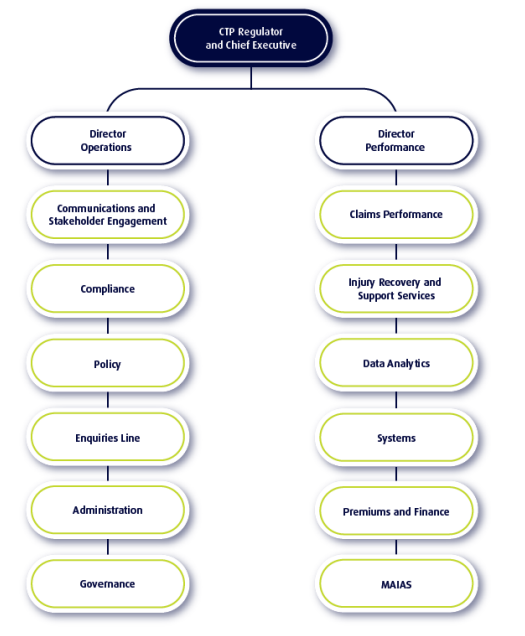

Kim Birch is the CTP Regulator (Regulator) and Chief Executive (CE) and responsible for carrying out the functions of the CTP Regulator and the CE as determined by the Compulsory Third Party Insurance Regulation Act 2016. The Regulator is also the Motor Accident Injury Accreditation Scheme (MAIAS) Administrator under the Civil Liability Act 1936.

Kerry Leaver is the Director Operations responsible for corporate functions including administration, communication, policy and risk and compliance. The Directorate is responsible for monitoring CTP Insurers and providing information to motorists.

Ivan Lebedev is the Director Performance, responsible for scheme performance operations, systems and processes required for scheme monitoring, corporate finance and the process of determining premium ranges for premium classes.

- Compulsory Third Party Insurance Regulation Act 2016

- Part 4, Motor Vehicles Act 1959

The Regulator has a service level agreement with the Department of Treasury and Finance (DTF) for the provision of corporate services to keep administration costs down and support the effective functioning of the Regulator’s office.

Our significant relationships to support scheme efficiency and administration are with:

- Department of Planning, Transport and Infrastructure for the collection and disbursement of CTP premiums.

- Lifetime Support Scheme and ReturntoWorkSA to share information to support injured people during their claim, streamline processes and improve recovery outcomes for injured people.

- Australian Prudential Regulation Authority regarding the financial stability and solvency of the CTP Insurers.

In 2019-20 the Regulator had Memorandums of Administrative Arrangement (MoAA) with government agencies to provide the following services to the scheme:

- Road safety: Department of Planning, Transport and Infrastructure and South Australia Police

- Emergency transport, hospital and forensic services: Department for Health and Wellbeing; Forensic Science SA (on behalf of Attorney-General’s Department); SA Ambulance; State Rescue Helicopter Service (on behalf of Attorney-General’s Department)

- Customer support and transaction processing: Department of Planning, Transport and Infrastructure.

These MoAAs are funded from the administrative component of the CTP premium collectively known as scheme services. The scheme services fees are detailed on page 28 of the report.

The agency's performance

The 2019-20 year marked the first year of the competitive scheme where motorists were able to choose from one of the four government approved CTP Insurers. The transition to the competitive scheme resulted in the following milestones:

- Education of South Australian motorists on how to choose a CTP Insurer. There is more information on the evaluation of the public education activities in the "Competition scheme implementation" section of this report.

- Provision of information on the competitive scheme including an interactive premium calculator on the CTP Regulator website.

- Competition across the majority of premium classes with CTP Insurers refiling premiums a total of five times.

- Increase in claimant service rating throughout 2019-20 demonstrating improvements in customer service for the overall benefit of the scheme.

In addition to the milestones associated with the competitive scheme, the Regulator delivered on strategic goals to support the efficiency of the insurance business. Operational highlights include:

- New compliance framework to monitor CTP Insurers against obligations introduced from 1 July 2019. There is more information on the Regulator’s compliance framework in the "Scheme monitoring" section of this report.

- CTP insurance district boundary review which confirmed the majority of postcodes or suburbs were assigned to the correct district. The review resulted in approximately 44,000 (or 3%) registered vehicles (based on 30 June 2019 vehicle registration data) being moved to the appropriate district. More information on the district boundary review can be read in the "Insurance rating district boundary review" section of this report.

- Review and development of scheme information fact sheets and brochures to assist claimants in interacting with the scheme on issues including children’s claims, financial hardship, liability determination, independent assessments, ISV medical assessments, complaints and disputes, settling a claim and recovering from injuries.

The MAIAS Administrator completed the 2019 quality assurance audit. There is more information on MAIAS activities in the "Motor Accident Injury Accreditation Scheme (MAIAS)" section of this report.

The Regulator’s strategic objectives align with the Government’s priorities of delivering lower costs and better services.

The premium bands determined by the Regulator for the 2019-20 financial year delivered savings to the majority of motorists. The Regulator has a commitment to responding to complaints and enquiries within 10 business days. The introduction of the claimant service rating promotes the importance of providing better service to South Australian motorists.

The Regulator’s strategic objectives help it perform the statutory functions under section 5 of the Compulsory Third Party Insurance Regulation Act 2016.

The Regulator’s performance against strategic objectives is summarised below.

Performance indicator | Target date | Outcome |

|---|---|---|

Objective 1: Oversee a financially sustainable, efficient and effective scheme | ||

Premium bands set for each premium class | May 2020 | Achieved |

Evaluation of community information and education campaign | June 2020 | Achieved |

Completion of MAIAS accreditation | July 2019 | Achieved |

Execution of Memorandums of Administrative Arrangement for road safety funding | September 2019 | Achieved February 2020, administrative delays, no impact to services |

Develop relationships with the Centre for Automotive Safety Research (CASR) | June 2020 | Achieved |

Implement the process to analyse dealer transactions to identify dealer-insurer relationships | December 2019 | Achieved |

Competition scheme project evaluation | September 2019 | Achieved |

Undertake a district boundary review | June 2020 | Achieved |

Implement fraud management framework | December 2020 | On track |

Objective 2: Promote an outcomes driven, early recovery and service focused approach to claims management | ||

Complete review of the Early Notification Form (ENF) and propose new process | January 2020 | Achieved |

Complete the MAIAS quality audit for 2019 | December 2019 | Achieved January 2020 |

Establish the Regulator's referral process to the Legal Services Commission for claimants | June 2020 | Achieved |

Introduce a survey process to measure the claimant's experience | March 22 | On track |

Objective 3: Meet our regulatory and statutory obligations | ||

|---|---|---|

Develop and evaluate a revised scheme risk and compliance framework | February 2020 | Achieved |

Undertake internal audit of scheme data storage and management by the Regulator | November 2019 | Achieved |

Determine the Open Data Policy for the Regulator | April 2020 | Achieved |

Evaluate the 2019 MAIAS accreditation | August 2019 | Achieved |

Internal audit program is undertaken and systems established as recommended | June 2020 | Achieved |

Introduce a sustainable, appropriate annual scheme risk and compliance planning cycle | June 2020 | Partially achieved, to be completed in 2020-21 |

Procure a medical review panel for MAIAS | September 2020 | On track |

Increase scheme performance transparency | March 2021 | On track |

Implement new MAIAS website and learning management system | March 2021 | On track |

Objective 4: Enhance the capability of our team to lead the delivery of our vision and mission | ||

Deliver service improvements from the review of our complaints management framework | June 2020 | Achieved |

Complete the organisational recruitment plan 2019 | December 2019 | Achieved |

Establish the operational management structure and systems to support corporate governance | May 2020 | Achieved |

Engage a consultancy to support senior management team development | February 2020 | Achieved |

Deliver service improvements from the review of our complaints management framework | March 2020 | Achieved June 2020 |

Develop a skills capability framework | June 2020 | Partially achieved, to be completed in 2020-21 |

Capacity building placement for people with disability | December 2021 | On track |

Develop systems and processes to analyse and act on staff feedback | October 2020 | On track |

Deliver our customer service framework | June 2021 | On track |

During 2019-20 the Regulator:

- improved business continuity plans and processes

- implemented a corporate governance framework project to review and improve governance structures across the team

- conducted continuous improvement and maintenance of information technology systems

- supported staff to move to flexible working arrangement in response to the COVID-19 pandemic

- monitored the impacts of COVID-19 on the Regulator and the scheme to ensure no interruption to services.

Further information about the Regulator’s performance in the 2019-20 financial year is detailed in the section “Reporting required under the Compulsory Third Party Insurance Regulation Act 2016”.

Regulator staff access Department of Treasury and Finance’s (DTF) performance management and development systems. All staff have performance plans in place that are reviewed every six months. The Regulator also provided tailored training courses for staff in 2019-20:

- All new Regulator staff completed a tailored business writing course to improve quality and increase confidence and enjoyment in written work. This course included a component to assist managers in providing positive feedback to encourage staff and improve overall performance

- All Regulator staff were given the opportunity to complete resilience skills training

- A skills development training plan was introduced for managers

Regulator staff access DTF’s work health, safety and return to work programs.

Regulator staff are employed by DTF and seconded to the Regulator. No work health and safety breaches, workplace injury claims, notifiable incidents or improvement and prohibition notices have been recorded by the Regulator.

Executive classification | Number of Executives |

|---|---|

SAES Level 1 | 2 |

SAES Level 2 | 1 |

The Office of the Commissioner for Public Sector Employment has a workforce information page that provides further information on the breakdown of executive gender, salary and tenure by agency.

Financial performance

The following is a brief summary of the overall financial position of the Regulator excluding GST and stamp duty receipts and payments. The information is unaudited. Full audited financial statements for 2019-20 are attached to this report.

Statement of Comprehensive Income | 2019-20 Budget $000s | 2019-20 Actual $000s | Variation $000s

| Past year 2018-19 Actual $000s |

|---|---|---|---|---|

Total Income | 64,381 | 65,173 | 792 | 62,873 |

Total Expenses | 64,381 | 58,956 | (5,426) | 62,498 |

Net Result | 0 | 6,217 | 6,217 | 375 |

Total Comprehensive Result | 0 | 6,217 | 6,217 | 375 |

Statement of Financial Position | 2019-20 Budget $000s | 2019-20 Actual $000s | Variation $000s

| 2018-19 Actual $000s |

|---|---|---|---|---|

Current assets | n/a | 35,086 | n/a | 13,920 |

Non-current assets | n/a | 342 | n/a | 645 |

Total assets | n/a | 35,428 | n/a | 14,565 |

Current liabilities | n/a | 18,451 | n/a | 3,977 |

Non-current liabilities | n/a | 510 | n/a | 338 |

Total liabilities | n/a | 18,961 | n/a | 4,315 |

Net assets | n/a | 16,467 | n/a | 10,250 |

Equity | n/a | 16,467 | n/a | 10,250 |

The following is a summary of external consultants that have been engaged by the Regulator, the nature of work undertaken, and the actual payments made for the work undertaken during the financial year.

Consultancies | Purpose | $ Actual payment |

|---|---|---|

All consultancies below $10,000 each - combined | Various | $0 |

Consultancies | Purpose | $ Actual payment |

|---|---|---|

Taylor Fry Pty Ltd | Scheme actuarial services | $411,974 |

PriceWaterhouseCoopers | Internal audit | $154,780 |

Total | $566,754 | |

See also the Consolidated Financial Report of the Department of Treasury and Finance for total value of consultancy contracts across the South Australian Public Sector.

The following is a summary of external contractors that have been engaged by the agency, the nature of work undertaken, and the actual payments made for work undertaken during the financial year.

Contractors | Purpose | $ Actual payment |

|---|---|---|

All contractors below $10,000 each - combined | Various | $11,418 |

Contractors | Purpose | $ Actual payment |

|---|---|---|

Wavemaker | Competition model – communication | $360,766 |

Dr Michael Epstein | GEPIC training for MAIAS accreditation | $31,903 |

Haymakr | Claimant service rating | $20,900 |

Haymakr | Market research | $20,000 |

Dr Dwight Dowda | MAIAS quality assurance | $19,475 |

ReturnToWorkSA | MAIAS accreditation | $17,668 |

Wendy Tims Consulting | Organisation development | $15,525 |

Dr Beata M Byok | MAIAS quality assurance | $15,371 |

Biz Hub Australia Pty Ltd | Personal Injury Register annual support | $14,719 |

Total | $527,743 | |

The details of South Australian Government-awarded contracts for goods, services, and works are displayed on the SA Tenders and Contracts website. View the agency list of contracts.

The website also provides details of across government contracts.

Refer to the Reporting required under the Compulsory Third Party Insurance Regulation Act 2016 section of this report.

Risk management

During 2019-20, the Regulator:

- established a risk and audit committee to review, assess and monitor strategic and operational risks and internal audit activities

- completed the inaugural schedule of the outsourced internal audit program

- developed a risk appetite statement

- conducted a risk culture survey.

Category/nature of fraud | Number of instances |

|---|---|

Timesheet fraud | 2 |

NB: Fraud reported includes actual and reasonably suspected

The Regulator has a robust suite of policies and work instructions to identify key risks and controls and mitigate the risk of fraud. These controls include but are not limited to:

- segregation of duties

- delegations of authority

- user restrictions to financial software

- asset registers

- triennial employee criminal history screening

- independent internal audit function

- financial management compliance program

- staff training and education on policies and procedures

- requirement of staff to adhere to the Public Sector Code of Conduct

- annual Conflict of Interest Declaration process for all staff.

There were no occasions on which public interest information was disclosed to a responsible officer of the agency under the Public Interest Disclosure Act 2018.

Note: Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1 July 2019.

Reporting required under the Compulsory Third Party Insurance Regulation Act 2016

This section of the report details the operational activities performed to meet the Regulator’s functions under the Act.

In May 2019 the Regulator commenced a public information and educational campaign to assist motorists to choose their CTP Insurer. The campaign ran to the end of June 2020 to align with all motor vehicle owners completing a registration renewal following changes to the scheme.

The education and information materials for the introduction of the competitive scheme informed the community about the changes to the scheme to enable them to actively participate and successfully select a CTP Insurer. The key communication channels were:

- the Regulator website

- a leaflet inserted into registration renewal notices

- a video for the Regulator’s website and Service SA waiting areas

- social media and website tiles on Department for Infrastructure and Transport and Service SA website pages.

There was a significant increase in visitation to the competition scheme website pages from May 2019 onwards, with the most significant visitation increases occurring in the first three months of the scheme (up to 30 September 2019). The overall level of enquiries (to the Regulator’s Enquiries Line and Service SA) did not increase as a result of changes to the scheme, demonstrating the communications strategy worked in informing motorists of the change.

More than 1,000 South Australian motorists responded to an online survey in October 2019 on their awareness of changes to the scheme. More than two thirds (69%) were aware of changes to CTP insurance and the majority (74%) gained that knowledge via the registration renewal notice.

The formal evaluation of the communications strategy (online survey of 415 motorists in June 2020) found the materials were positively received and delivered extremely high awareness of the change:

- Awareness of the change to the CTP process was nearly universal at 95%

- Almost everyone (95%) found the renewal process easy

- Motorists remain positive with 59% liking the change

- Since premium price equalisation for some premium classes occurred, price has decreased as a perceived benefit of insurer choice. The ability to choose an insurer is now the top benefit followed by the ability to choose the insurer with the best service.

The CTP Insurers competed on price throughout the 2019-20 year by refiling premiums a total of five times with price competition across the majority of premium classes.

During 2019-20, all insurers’ premium prices moved to the Regulator’s lowest band rate determined in the private passenger and goods carrying light premium classes, which represent approximately 85% of the total number of registered vehicles excluding trailers.

The Regulator’s policy acquisition data for 2019-20 demonstrate that the claimant service rating, which is displayed on the registration renewal form, is a key factor used by motorists to choose their CTP Insurer.

The 2019 amendments to the Motor Vehicles Act 1959 (MV Act) enabled CTP Insurers to offer incentives to policy holders. In 2019-20 CTP Insurers offered incentives including rewards programs, gift cards and discount off other insurance products. The classes of incentives insurers are able to offer are approved by the Treasurer and published on the Regulator’s website.

Changes to the MV Act retained auto-allocation of CTP Insurers for new motor vehicle registration. Motorists are able to switch insurer after the purchase of a new vehicle. A total of 71,243 policies were auto-allocated in 2019-20 and a total of six motorists chose a different insurer after purchasing their new vehicle.

Key activities completed in 2019-20 include:

- Determination of new premium bands to apply from 1 July 2020 resulting in sustained price competition across the majority of premium classes. Based on the lowest filed premium rate, premiums did not increase in 44 premium classes, representing 96% of the total projected number of registered vehicles excluding trailers.

- Introduction of a new Regulator Rule on 1 June 2020 to manage the release of a vehicle collision report (VCR) by a CTP Insurer to the claimant.

- Minor changes were made to the determination of premium classes throughout the year including amending the definitions of rideshare and hire car classes to ensure premiums are fair and reasonable to all motor vehicle owners.

- Release of a suite of new communication tools to assist claimants in their interaction with the scheme. Of note:

- A new brochure was developed with information for motor vehicle owners and drivers. It provides general information on the scheme including what is covered, CTP premiums and frequently asked questions. It also provides a consistent central source of information that can be distributed by CTP Insurers to motorists.

- A new fact sheet to support those affected by a fatal motor vehicle collision. Developed in consultation with SAPOL Major Crash, the Commissioner for Victims’ Rights and CTP Insurers, the fact sheet is distributed by police supporting the family. It contains information to connect the claimant to the right CTP Insurer to support them through the claims process at a difficult time.

- Continuous improvement of the Personal Injury Register (PIR) including updates to the payment codes to allow for better reporting and data analysis of the scheme. The PIR contains information on all claims received and payments made under the scheme since 1 July 2016. The information is used to regulate the CTP Insurers, analyse performance of the scheme, and in determining premiums.

- Roadshow presentations to each CTP Insurer claims staff to provide information about the Regulator’s requirements including:

- new Regulator Rules which commenced from 1 July 2019

- customer service

- 2019-20 compliance framework

- importance of scheme data

- Motor Accident Injury Accreditation Scheme (MAIAS).

- Commencement of injury recovery audits of CTP Insurers to assess the implementation and application of the Injury Recovery and Early Intervention Framework for assessing reasonable and necessary treatment.

- Facilitated operational improvements including:

- Implementation of an injury management forum with CTP Insurers to identify and address common barriers or emerging issues for claimants that impact reasonable and necessary injury recovery services.

- Implementation of an online version of Allied Health Management Plans to increase ease of use and accessibility of the forms for health providers and CTP Insurers

- Introduction of a Voluntary Medical Certificate to streamline information provided to CTP Insurers at the start of a claim, which supports injured road users to receive timely treatment for their injuries and progress their CTP claim.

The Regulator conducted a review of the CTP insurance rating district boundary (boundary). The results of the review are explained in the CTP Insurance Rating District Boundary Review Report, available on the Regulator website.

The boundary separating the districts had not been reviewed since it was established in 2002. Periodic review of the boundary assures the Regulator that premiums are applied fairly across the community.

Vehicle garaging location is one of four factors that can apply in setting premiums. A vehicle garaging address falls into one of two insurance rating districts. District 1 represents higher populated areas (roughly corresponding to metropolitan Adelaide) and has a greater number of CTP claims per 1,000 registered vehicles and cost per CTP policy. District 2 represents less populated areas and has a lower claim frequency and cost per policy.

The Regulator based analysis on six years of claims data, from 1 July 2013 to 30 June 2019. This data was used to calculate the claim frequency for each suburb and postcode. The review required a number of criteria to be met before a postcode or suburb could move district.

As a result of the review, the Regulator amended the boundary between districts 1 and 2, under the powers to determine premiums in the Act.

The review identified areas where the number of CTP claims and the number of policies per 1,000 registered vehicles were inconsistent with their current district classification. The review resulted in approximately 44,000 (or 3%) registered vehicles (based on 30 June 2019 vehicle registration data) being moved into the appropriate district.

Approximately 16,000 vehicles in four suburbs moved from district 2 to 1 and the majority experienced an increase in premium. Approximately 28,000 vehicles in 42 suburbs moved from district 1 to district 2 and the majority experienced a decrease in premium.

As a result of the review the scheme funding remains the same. The newly defined district boundary alters the contribution each area makes to the funding.

The Regulator has adopted a 10-year review cycle because it allows for enough data to accumulate for claim frequency analysis.

The Regulator uses a suite of tools to oversee scheme performance and to identify areas for further investigation in scheme trends, CTP Insurer performance and data quality.

Benchmarking reports have an operational focus and compare individual insurer performance with their competitors on key claims management activities such as claims acceptance or denial, claims closure, re-opening and settlements.

Benchmarking reports are provided to CTP Insurers to help them assess their performance against the rest of the market. These reports are also a key tool for the Regulator to closely monitor data quality. The accuracy of the data is important in monitoring the scheme experience and premium setting.

In addition, the Regulator monitors the compliance of CTP Insurers with contractual and legislative obligations using the compliance framework. The framework is risk based, targeting areas of highest priority for the scheme. The framework prescribes compliance activities, including:

- claims management reviews

- data analytics

- mandatory declarations.

The 2019-20 compliance program introduced an in-depth end-to-end assessment of each CTP Insurer’s business, which included:

- claims communication

- service levels provided to claimants

- compliance with legislative obligations

- treatment approval and injury recovery

- complaints and dispute resolution

- payments and settlements

- management and protection of personal and confidential information

- oversight of third party providers.

Due to disruptions caused by COVID-19 and the ability for on-site audits to be conducted the completion of the 2019-20 compliance program was delayed, to be completed in the 2020-21 financial year.

Where the compliance program identified findings, CTP Insurers were required to submit remediation plans which are tracked monthly against agreed deadlines and outcomes.

Any areas considered non-compliant can result in CTP Insurers being issued with breach notices. A total of 46 breaches were issued in 2019-20 as shown in the table below, of which 24 are open as at 30 June 2020 and are being monitored by the Regulator.

The most common areas of breaches included:

- privacy

- not providing reports/information to claimants as required within 21 days

- not providing timely reimbursement of claimant expenses

- complaints management.

CTP Insurer breaches issued in 2019-20

CTP Insurer | Breaches |

|---|---|

AAMI | 7 |

Allianz | 16 |

QBE | 15 |

SGIC | 8 |

In addition, CTP Insurers paid eight sanctions to the total value of $110,000 to the State Government.

The objective of MAIAS is to create an independent system that provides consistent, objective and reliable Injury Scale Value (ISV) medical assessments. It accredits health professionals to undertake ISV medical assessments which includes assigning an injury Item Number based on the assessment of injuries sustained in motor vehicle accidents.

In 2019-20 the MAIAS Administrator developed a strategic plan for the MAIAS to prioritise areas of development and improvement, detailed below.

Accreditation

In 2019-20 MAIAS completed the first re-accreditation of medical practitioners since the introduction of MAIAS in 2015. MAIAS collaborated with the Return to Work Impairment Assessor Accreditation Scheme, administered by ReturntoWorkSA to develop a joint process for applications, training and competency assessments, creating efficiencies.

Telehealth for GEPIC ISV medical assessments

The COVID-19 pandemic led to a review of processes that could be amended to support claimants during pandemic conditions. Work was undertaken to develop a trial process of telehealth conferencing for pure mental harm GEPIC assessments where it is safe and clinically appropriate to do so. The trial commenced in the 2020-21 financial year.

Quality assurance program

MAIAS completed a review of a sample of ISV medical assessments completed between 30 June 2018 and 31 August 2019. The purpose of the review was to monitor the compliance of Accredited Medical Practitioners (AMPs) with their obligations contained in the, Civil Liability Act 1936, Civil Liability Regulations 2013 and the accreditation criteria from the MAIAS Training Manual to identify issues and provide ongoing education and feedback to AMPs.

The sample of reports covered AMPs who, as a group, produced at least 90% of all reports completed during the review period. This limited individual samples to five per AMP.

A review was conducted of 125 ISV medical assessments for physical injury produced by 25 AMPs. The results show a deterioration in compliance across a number of criteria compared to the 2018 program. However there was an improvement in results for 17 reports which were completed after the 2019-2022 accreditation process.

The key issues identified were: AMPs either not using or modifying the prescribed ISV medical assessment templates; assessment of injury stability for all referred injuries, non-substantiated calculation of the Whole Person Impairment; and application of the Pain Chapter (AMA 5).

Forty GEPIC ISV medical assessments for pure mental harm produced by eight AMPs were reviewed. It was not possible to compare results with 2018 due to the small sample size for the 2018 review program. Key issues identified in reviewing the pure mental harm reviews were: providing a diagnosis assessed as arising from pure mental harm or consequential mental harm, providing a GEPIC rating with detailed reasons, providing sound reasoning and a clear rationale for their opinion.

A training program has been developed for 2020-21 to support AMPs to meet their accreditation obligations to deliver a compliant report.

Insured vehicles by type

(Registrations as at 30 June 2020)

Type of vehicle | Vehicles | % |

|---|---|---|

Private passenger | 1,063,106 | 57.74% |

Public passenger: no fare | 655 | 0.04% |

Taxis: metropolitan | 904 | 0.05% |

Taxis: country | 246 | 0.01% |

Hire cars | 5,032 | 0.27% |

Rideshare | 4,014 | 0.22% |

Public passenger: small | 754 | 0.04% |

Public passenger: medium | 984 | 0.05% |

Public passenger: heavy | 606 | 0.03% |

Public passenger: omnibus | 1,050 | 0.06% |

Goods carrying: light | 209,729 | 11.39% |

Goods carrying: medium | 15,299 | 0.83% |

Goods carrying: heavy | 9,795 | 0.53% |

Goods carrying: primary producers | 29,967 | 1.63% |

Motorcycles: ultra light | 3,326 | 0.18% |

Motorcycles: light | 8,469 | 0.46% |

Motorcycles: medium | 12,270 | 0.67% |

Motorcycles: heavy | 19,166 | 1.04% |

Tractors | 53,205 | 2.89% |

Historic and left hand drive vehicles | 31,109 | 1.69% |

Special purpose vehicles | 15,139 | 0.82% |

Car carriers: light | 1 | 0.00% |

Car carriers: medium | 21 | 0.00% |

Car carriers: heavy | 1 | 0.00% |

Car carrier trailers | 119 | 0.01% |

Trailers | 356,305 | 19.35% |

Total | 1,841,272 | 100.00% |

Source: Department for Infrastructure and Transport policy data.

Ratio of class 1 premium(1) to South Australian average weekly earnings (AWE)(2)

Annual premium(1) | State AWE(2) | Ratio | |

|---|---|---|---|

2019-20 | $296.77 | $1,504 | 20% |

2018-19 | $411.25 | $1,462 | 28% |

2017-18 | $400.75 | $1,442 | 28% |

2016-17 | $389.00 | $1,446 | 27% |

Note: (1) Premium is the weighted average lowest priced Class 1 District 1 public passenger vehicle (private use, no input tax entitlement) on offer over the financial year.

(2) Source: Australian Bureau of Statistics, 6302.0 Average Weekly Earnings, Australia. Earnings; Persons; Full Time; Adult; Ordinary time earnings; South Australia; Series Id: A84989336X, November (in given financial year).

Premium and fee collection

(1 July 2019 to 30 June 2020)

Description | $'000 |

|---|---|

Insurers' premiums* | 308,359 |

Stamp duty | 41,354 |

Road safety | 14,390 |

Emergency transport, hospital and forensic services | 31,515 |

Customer support and transaction processing | 10,693 |

CTP Scheme regulation and administration | 8,577 |

Total insurance premiums collected | 414,888 |

Note: *Includes GST.

Market share

| AAMI | Allianz | QBE | SGIC |

|---|---|---|---|---|

30 June 2020 | 28% | 27% | 21% | 24% |

30 June 2019* | 30% | 15% | 35% | 20% |

30 June 2018* | 30% | 15% | 35% | 20% |

30 June 2017* | 30% | 15% | 35% | 20% |

Note: *All insurers had contractually agreed market share for the first three years.

Claimant service rating results

Publication month | AAMI | Allianz | QBE | SGIC |

|---|---|---|---|---|

June 2020 | 81 | 72 | 77 | 85 |

June 2019 | 69 | 72 | 71 | 70 |

Note: The score published each month is the average claimant service rating from claimants surveyed in the previous six months.

Supplementary claimant service survey questions – scheme average

Publication month | Q1 | Q2 | Q3 | Q4 | Q5 | Q6 |

|---|---|---|---|---|---|---|

June 2020 | 77 | 75 | 84 | 82 | 88 | 81 |

June 2019 | 71 | 67 | 79 | 77 | 85 | 76 |

The supplementary questions are asked after the main claimant service rating question. They are:

Question 1: Responding to needs in a timely manner

Question 2: Being kept up-to-date with claim progress

Question 3: Case manager’s knowledge

Question 4: Provided information is easy to understand

Question 5: Case manager’s friendliness and helpfulness

Question 6: Provided with all the needed information

Note: The values shown are the average of results of all claimants surveyed in the previous six months.

Number of accidents by region

(Accidents from 1 July 2019 to 30 June 2020)

Region | Accidents | % |

|---|---|---|

Adelaide City / Suburbs | 1,171 | 85.3% |

Outer Adelaide | 111 | 8.1% |

Murraylands | 30 | 2.2% |

South | 13 | 0.9% |

Northern | 12 | 0.9% |

Eyre | 15 | 1.1% |

Interstate | 20 | 1.5% |

Total | 1,372 | 100% |

Note: The recent accident years’ data is immature due to accidents where a claim is yet to be reported.

Claim lodgement by development year

(All claims for accidents from 1 July 2016 to 30 June 2020)

Development year | |||||

|---|---|---|---|---|---|

Accident year | 1 | 2 | 3 | 4 | Total |

2016-17 | 2,376 | 630 | 50 | 29 | 3,085 |

2017-18 | 2,120 | 470 | 56 | 2,646 | |

2018-19 | 1,931 | 430 | 2,361 | ||

2019-20 | 1,558 | 1,558 | |||

Total |

|

|

|

| 9,650 |

Note: Development year 1 means claims lodged in the accident year (year means financial year), development year 2 means claims lodged in the next year after the accident year, etc.

Claimants by demographic

(All claims for accidents from 1 July 2016 to 30 June 2020)

Age group | Males | Females | Total | % |

|---|---|---|---|---|

0-5 | 62 | 48 | 110 | 1% |

6-15 | 131 | 158 | 289 | 3% |

16-25 | 601 | 838 | 1,439 | 15% |

26-35 | 830 | 1,020 | 1,850 | 19% |

36-45 | 755 | 938 | 1,693 | 18% |

46-55 | 851 | 955 | 1,806 | 19% |

56-65 | 645 | 704 | 1,349 | 14% |

66+ | 484 | 630 | 1,114 | 12% |

Total | 4,359 | 5,291 | 9,650 | 100% |

Claims by severity

(Closed claims for accidents from 1 July 2016 to 30 June 2020)

AIS* severity | Claims | % |

|---|---|---|

Minor | 3,398 | 60.3% |

Moderate | 537 | 9.5% |

Serious | 189 | 3.4% |

Severe | 12 | 0.2% |

Critical | 3 | 0.1% |

Maximum | 103 | 1.8% |

Admin only | 1,395 | 24.7% |

Total | 5,637 | 100.0% |

Note:

*Injury severity based on injuries coded under the Abbreviated Injury Scale 2008 (AIS 2008).

“Minor” category includes claims where a region-specific injury code was reported with a severity of 9 (“not further specified”).

“Maximum” injury severity usually indicates a fatality.

“Admin” means there were no physical injuries caused by the accident or there was no medical evidence available for injury coding.

Rates of legal representation

(Accidents from 1 July 2016 to 30 June 2020)

Accident year | Claims | % Closed | % Legal rep | % Litigated |

|---|---|---|---|---|

2019-20 | 1,558 | 26% | 25% | 0.1% |

2018-19 | 2,361 | 52% | 26% | 0.3% |

2017-18 | 2,646 | 62% | 36% | 1.7% |

2016-17 | 3,085 | 76% | 38% | 12.3% |

Note: The recent accident years’ data is immature due to the long tail nature of CTP claims.

Claim duration by CTP Insurer

(Closed claims for accidents from 1 July 2016 to 30 June 2020 where relevant data is available)

Timeframe | AAMI | Allianz | QBE | SGIC | Average |

|---|---|---|---|---|---|

Notification date to compliance date | 1.0 | 1.3 | 0.5 | 1.5 | 1.0 |

Notification date to liability decision date | 3.9 | 3.4 | 4.3 | 3.8 | 3.9 |

Notification date to closure date | 13.5 | 11.2 | 10.8 | 10.9 | 11.7 |

Note: Timeframe is average month(s).

Heads of damage breakdown

(Closed claims from 1 July 2019 to 30 June 2020 for accidents from 1 July 2016 to 30 June 2020)

Heads of damage | Closed claims | % Closed payments |

|---|---|---|

Care | 683 | 17% |

Economic loss | 576 | 37% |

Non-customer benefits | 1,683 | 19% |

Non-economic loss | 207 | 5% |

Other customer benefits | 434 | 1% |

Treatment | 1,925 | 21% |

Total | 2,087 | 100% |

Note:

“Care” category includes payments for past and future care and home services, care-related travel and voluntary services.

“Non-customer benefits” category includes investigation costs, the costs of medical reports from treating medical providers and ISV medical assessors, and plaintiff and defendant legal costs.

“Other customer benefits” category includes claimant travel expenses and reasonable funeral costs. In the 2018-19 annual report this category included payments to surviving spouse and/or children for the loss of family member, payments to partners of injured persons for the loss of companionship, and rehabilitation costs. These payment types have now been moved to other heads of damage in the table.

“Treatment” category includes payments for past and future medical, allied health and hospital services, excluding public hospital services funded from the administrative fee component of CTP premiums.

Nil claims (zero payments) have been excluded from the data.

Nominal defendant claims received by accident year

(Accidents from 1 July 2016 to 30 June 2020)

Year of accident | Unidentified vehicles | Unregistered vehicles | Total |

|---|---|---|---|

2019-20 | 42 | 13 | 55 |

2018-19 | 60 | 20 | 80 |

2017-18 | 73 | 19 | 92 |

2016-17 | 88 | 17 | 105 |

Note: The recent accident years’ data is immature due to accidents where a claim is yet to be reported.

Public complaints

Type | Number of instances |

|---|---|

Complaints about CTP Insurers | 32 |

Complaints about the scheme | 12 |

Complaints about the Motor Accident Injury Accreditation Scheme | 1 |

Complaints about the Regulator | 0 |

Total enquiries to the Regulator in 2019-20 by source

Enquirer source | Number of enquiries |

|---|---|

General public | 4,944 |

CTP Insurer | 688 |

Medical | 407 |

Legal | 219 |

Government department | 179 |

Peak body | 47 |

Media | 11 |

Interstate regulators | 5 |

Total | 6,500 |

Enquiries from the general public in 2019-20 by enquiry category

Enquiry category | Number of enquiries |

|---|---|

Claims | 2,532 |

Registration or other insurance* | 1,288 |

Competition scheme | 559 |

CTP Scheme | 358 |

Complaints | 104 |

Operations | 91 |

MAIAS | 12 |

Total | 4,944 |

Note: *Registration or other insurance enquiries include calls about comprehensive insurance and vehicle registration outside the responsibility of the CTP Regulator. The number for “Complaints” does not match the number of complaints listed in the public complaints section of this annual report because each complaint can involve a number of enquiries and this category also includes questions about the complaints process that do not result in a complaint being lodged with the Regulator.

Service improvements resulting from complaints or consumer suggestions over 2019-20

The Regulator has a commitment to respond to all enquiries and complaints within 10 business days. In 2019-20 improvements were made to enquiries scripts and the internal complaints and enquiries management process to improve the flow of information and response times. This allowed complaints to receive a response in an average of six days, and non-standard enquires to receive a response in an average of three days.

All enquiries received are recorded and monitored, and this information is used to improve our tools to better inform motorists, injured people and other stakeholders about the scheme.

Enquiries and complaints are reviewed against available website information to inform changes to our website and other communications materials so information is accurate, clear and accessible.

In 2019-20 the Regulator made the following amendments to website information based on consumer enquiries and complaints:

- improved information on policy holder privacy and CTP Insurer privacy responsibilities

- updated information on how motorists choose a CTP Insurer to include brand, claimant service rating and available incentives, not just price.