How is the SA CTP Scheme structured?

CTP Insurers are approved by the government to provide CTP insurance. AAMI, Allianz, NRMA, QBE and Youi underwrite the Scheme and manage the claims against their policies of insurance.

The CTP Insurers are subject to state and federal legislation and contracts entered into with the State in delivering CTP insurance to South Australia.

The CTP Regulator regulates the Scheme, including CTP Insurers, for the benefit of road users.

The Department for Infrastructure and Transport issues registration renewal notices and provides premium collection services as part of the motor vehicle registration process.

See more information on the Regulator's role and the Regulatory Framework.

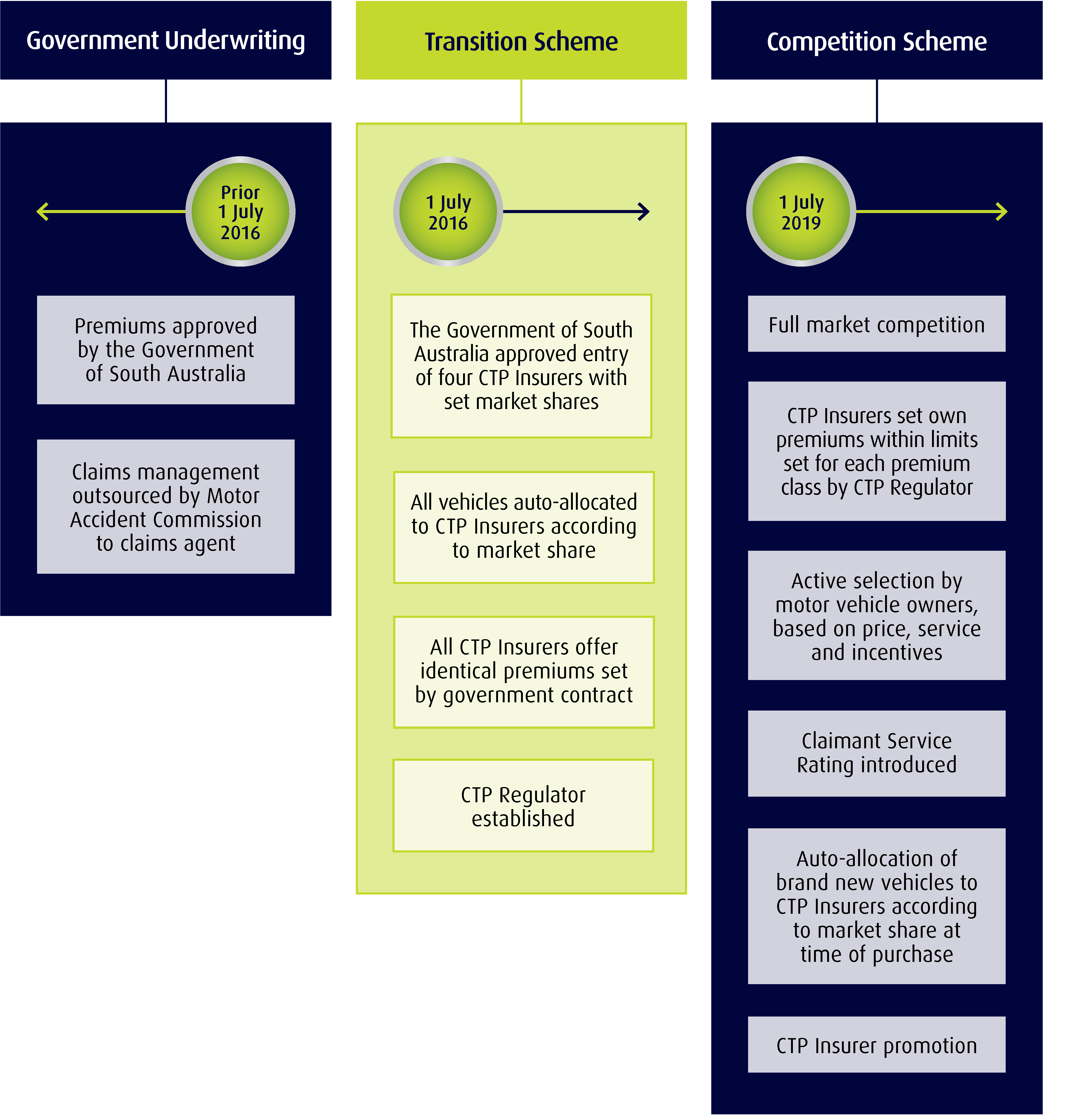

What has changed in the CTP Scheme?

The CTP Scheme Changes Fact Sheet provides you with easy-to-understand information about the CTP Scheme and how it has changed.

The changes are also summarised below.

Lifetime Support Scheme

The CTP Scheme works in conjunction with the Lifetime Support Scheme (LSS). The LSS is a no-fault scheme which provides treatment, care and support for people who have sustained very serious lifelong injuries in motor vehicle accidents in South Australia. The LSS is administered by the Lifetime Support Authority (LSA) under the Motor Vehicle Accidents (Lifetime Support Scheme) Act 2013.